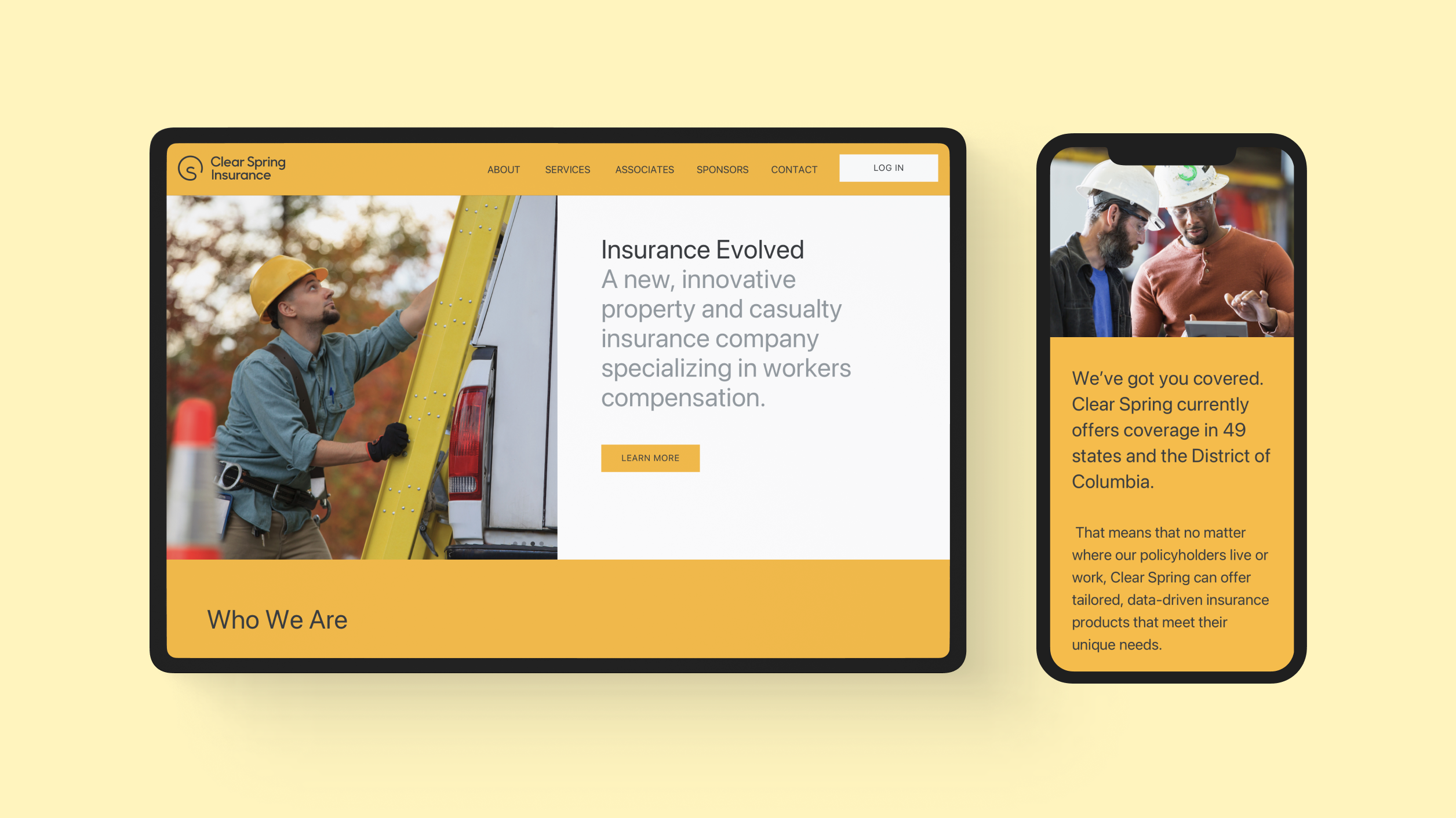

Creating a digital strategy for an innovative insurer

About the client

Clear Spring Property and Casualty Company is a subsidiary of Delaware Life Insurance Company and its parent company, Group1001.

Active Policies

300k+

Industry

Insurance

A.M. Best Financial Strength

A-

Assets Under Management

$43.3B

Project Overview

Opportunity

To meet the needs of the gig economy, insurance carriers need innovative risk management solutions that evolve with market trends.

Clear Spring Insurance was purpose-built to leapfrog traditional insurance companies with a focus on usage-based insurance products.

We developed a strategy to create a digital platform that rewarded Insurance Brokers for their level of partnership.

Minimize Dropped Opportunities. Producers were ready to bring over $850M in policy opportunities, and Clear Spring Insurance needed to be ready with automated opportunity ingestion, data-driven opportunity prioritization, and escalation of aging opportunities.

Minimize Time to Quote. Automation would be critical to rapidly respond to submissions and achieve a 10% success rate on new business quotes.

Maximize Conversion Rate. Best-in-class service and follow-up would develop a preference for Clear Spring Insurance among producers, which requires opportunity tracking tools and producer performance assessments.

Smarter Risk Assessment. By tracking submissions and policyholder data across business units, Clear Spring Insurance could make smarter risk assessments.

Distributed Operating Model. Even before the pandemic, Clear Spring Insurance was forward-thinking about coordinating jobs to be done across multiple third parties to hold them accountable and limit dependencies on any single vendor.

More results

Ready to jump?

Embrace the full power of your future with Fulton&Co.