Disruptors Surprise Linear Thinkers

Originally published as part of, “The Day Before Digital Transformation” by Phil Perkins and Cheryl Smith

In a memo from Jeff Bezos in the early 2000s to his entire organization of 150 people at Amazon, he laid out his seven basic tenets for building a successful digital business. His final two tenets were: “6) Anyone who doesn’t do this will be fired. 7) Thank you; have a nice day!” – Jeff Bezos[i]

No one is suggesting that transitioning from where your organization is today to incorporating digital technologies into your products and services will be easy. Change is difficult and those unhappy with the changes will throw up a multitude of roadblocks that will be difficult to overcome. But the advantages received by making the changes are real, the major one being your organization’s survival. Let’s be honest, the tech giants who invented and those who implemented and evolved the early digital technologies at the beginning of this age are not just winning. They are trouncing everyone.

For example, Amazon was incorporated in 1994. In 2019, on its 25th anniversary, its eCommerce revenues were almost equal to the total eCommerce revenues of all other retailers in the US, including Apple, e-Bay, Walmart, Target, and Home Depot combined. The changes required for retail organizations to compete now are major.[ii]

In the past ages, organizations that have incorporated the new technologies into their operations and product and service offerings have not only survived but survived through more than one age. As an example, these major US firms have been in business since the 1800s:[iii]

- AT&T

- Brooks Brothers

- Cigna

- Citigroup (City Bank of NY)

- DuPont

- Ford

- General Electric

- JP Morgan Chase

- Macy’s

- U.S. Steel

But this time, the Digital Age technologies present serious challenges to their operations, and to the operations of every established organization. AT&T has been able to stay in the game as a major player because it has been both an inventor and an adopter of digital communications technologies. And we expect that insurance companies and banks have remained because they are among the few industries whose core technologies have not yet been impacted by digital. But they will be. Brick and mortar organizations are having a more difficult time in the Digital Age because there are now digital competitors in those industries.

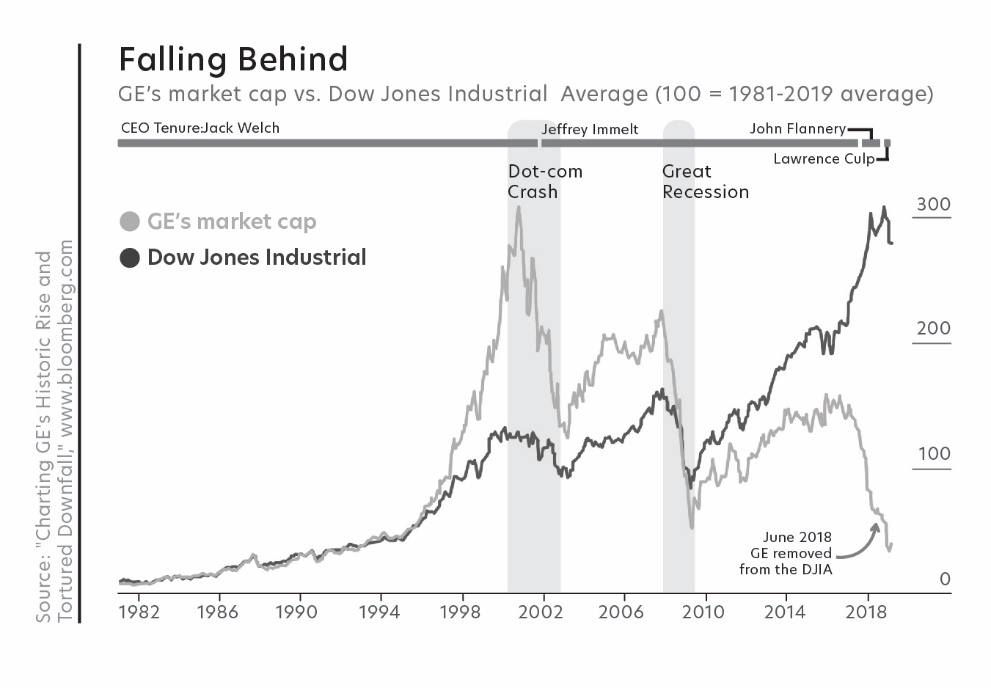

Figure 5 shows what has happened to a US superstar of the past two ages: General Electric.[iv]

The goal of organizations today is not to survive into the next century as it has been in past ages. This time the goal is to survive to the end of this decade.

- Brooks Brothers, the 200-year-old menswear retailor, filed for bankruptcy in July 2020.

- Ford, started in 1896 and incorporated in 1903, is viewed as a long-ailing stock facing new challenges to demand and supply chains.

- GE, founded in 1890 as the Edison General Electric Company and an original member of the DOW in 1896, was removed from the DJIA in June 2020.

- Macy’s woes predated the pandemic crisis as the company appears unable to break out of the long and slow death spiral it has been in as the world moves to digital sales, rendering real estate heavy operations that do not keep pace redundant.

- Exxon which joined the DJIA in 1928 as Standard Oil and was one of the largest publicly traded companies in the world for many years, was replaced by Salesforce.com in 2020.

Why do disruptors always surprise?

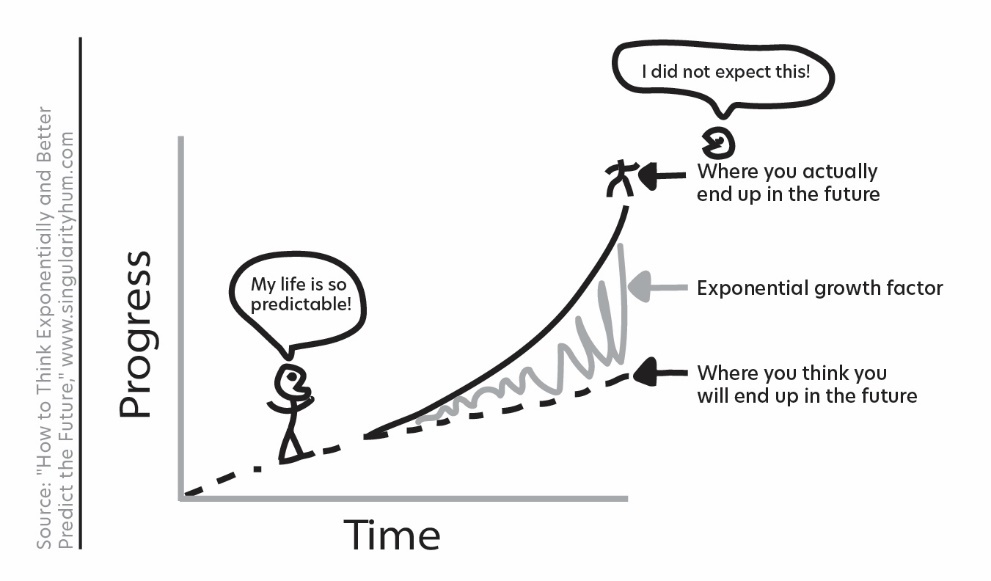

Digital disruptors always seem to surprise their competition. A major reason is that in the Digital Age we are starting to see a very real difference between linear and exponential change.[v] (Figure 6)

Entrenched competitors struggle to see the same future as disruptors because we have historically thought of the future in a linear fashion. We think that the world will move forward at the pace we have historically experienced. It took 12,000 years from cave dwellers to the first industrial revolution. It took 110 years from the First to the Second Industrial Revolution. The Second lasted 80 years, and the Third 70 years. This Fourth Industrial Revolution is predicted to last about 60 years. We can see the timeframes between the revolutions are shortening. As the processing power of computing doubles and the number of connected touchpoints expands every year, it creates exponentially more opportunities to be exploited.

For example, it can be helpful to think of each of the three phases of the Digital Age in terms of the number of devices connected to the Internet, using physical devices as a mental proxy for the amount of data being generated. Prior to this age, we had a few mainframes, which expanded into millions of computers as PCs became popular and affordable at the beginning of the Digital Age. Billions of mobile devices marked the mid-point, and we now are beginning the process of connecting trillions of devices, mostly sensors, as the Internet of Things (IoT) takes hold in the third phase.

Organizations that live in a world of 5% to 15% growth are seeing diminishing returns on continued improvements to products or services because investments are primarily geared toward maintaining the status quo or creating variants on existing products and services. Successful digital organizations have accepted that they need to incorporate digital technologies into their product and service offerings and ways of doing business because, as we will show, that is the path to exponential growth. An exponential approach enables new initiatives to appear to be non-threatening until it is too late for their competitors to catch up. Exponential growth is a topic that eludes many executives who have made a career out of maintaining and steadily growing existing revenue streams.

[i] Memo immortalized in Steve Yegge’s now-infamous Google Platform Rant, October 11, 2011.

[ii] “These 21 major retailers are worth less than Amazon…combined,” Helen Zhao, CNBC, September 7, 2018.

[iii] Authors’ research of top US-based by revenue companies from 1800 to today.

[iv] “Charting GE’s Historic Rise and Tortured Downfall,” Natasha Rausch, Yalman Onaran and Molly Smith, Bloomberg.com, January 30, 2019, Updated January 31, 2019.

[v] “How to Think Exponentially and Better Predict the Future,” Alison E. Berman, Jason Dorrier, and David J. Hill, singularityhum.com, April 5, 2016.