Transformation #3 Of 4: Connected Product

Organizations that pursue this strategy add technology into their products or services. This allows them to add new, differentiating functionality and to be the best at exploiting data on how the product or service is consumed to monetize improved product or service usage. A connected product or service transformation creates new digital revenue streams on top of existing products or services. It creates a higher-margin business that focuses on new monetization through outcome/consumption-based usage of the products or services. (Figure 24)

Selling the same product in the same old way is no longer enough to keep an organization afloat. In this strategy, the organization will add sensors and/or other emerging technologies to their existing products and services to add new, differentiating functionality, and to acquire data on how the product or service is used. This is a difficult mindset change for many organizations because it must shift its focus from delivering a product to delivering on the promised value customers get by purchasing the product. The automotive industry is no longer selling cars, it is selling transportation on demand. The battery industry is no longer selling batteries, it is making sure customer devices always have power. The diaper industry is no longer selling diapers, it is selling drier babies.

Like the Support System Transformation strategy, emerging digital organizations are leveraging outcome-based models that shift focus from the product or service to the problems they solve. In this model, consumers are typically charged for actual usage of the product instead of an upfront fee. A simple example would be a soda machine that charges consumers only for the number of ounces they drink. A more complex example is usage-based insurance, also known as ‘pay as you drive’ insurance. This type of car insurance organization charges consumers based on a multitude of factors – among them, driver behavior, distance driven, and the type of vehicle – creating a dynamic premium based on real user information.

This strategy is likely to apply to organizations in the autonomous vehicle, Gaming, Retail—Shoes, Retail—Accessories, Retail—Furniture, and Pharma (designer drugs). Organizations that consider this strategy usually have the following things in common:

- High margins that support the addition of sensors or other emerging technologies into the product or service without forcing price changes that make the product or service less appealing or inaccessible for customers. Organizations in this category typically differentiate by having complex and/or unique products or services that support high margins.

- High margins that allow for significant profitability at low volumes to support investments required by a connected product or service including connectivity, power management, and field management.

- Due to product or service complexity, these products or services typically have a few minor product SKU variants.

- Few organizations can afford the R&D costs or the costs to manufacture the product or service, which results in a small number of large players.

- Due to the advantages of scale, customer churn tends to be lower, which allows the organization to make higher capital investments in providing service to those customers.

A Connected Products or Services strategy collects a tremendous amount of data that is mined to better understand how customers use the product or service. This digital transformation will allow the organization to become a leader in its industry by creating better outcomes for its customers. By understanding how customers use the product or service, the organization must strive to lead its industry in delivering better outcomes in the use cases that leverage the product or service.

This digital transformation strategy will typically involve a combination of direct and indirect channels. Leaders will create a symbiotic relationship with partners while incentivizing their most loyal customers to interact directly with the organization’s own digital channels.

In this strategy, it is critical to focus on data about the product or service usage, such as:

- Product and service usage data provides insights on the usage of the product or service to understand the level of value the customer is getting from the service.

- Product and services operator data provides insights on the user of the product or service and assesses their ability to optimally leverage the connected product or service.

- Connectivity data for Smart connected products use various network tools to communicate with the outside world. There are many options for connectivity, and each has its own tradeoffs with respect to power consumption, range, bandwidth, obstacle penetration, and data cost.

- Field management data on your digital platform must be able to connect with, monitor, manage, control, and extract data from connected devices, of which there may be an enormous number, and which may be located in remote areas with spotty connectivity. Your platform must be able to send updates to and from edge devices on the fly, potentially without user intervention.

Emerging technologies that can be built into a product or service to improve functionality and better understand its usage are primary here. Secondary are the emerging technologies that engage with consumers and track their behaviors.

- Sensors and Communication Protocols are often added to products to understand their usage. The data can be used to develop actionable insights on how to improve the customers usage of the product.

- Virtual Reality (VR) and Augmented Reality (AR) and advanced connected products increasingly leverage VR and AR for preventative training, maintenance, and inventory management.

- Chatbot and NLP advanced connected products increasingly leverage conversational interfaces to achieve their goals.

- AI can be used to help identify optimal usage patterns and make recommendations to operators on how to improve their outcomes when using the product.

Digital revenue built on top of the deployed connected products should create more stable subscription revenue with higher gross margins. These gross margins will need to be reinvested in sales, marketing, and research and development.

Organizations using this strategy should expect to see an increase in short-term debt for inventory, because the cost of a connected product will most likely be higher than its previous iteration. They should simultaneously see an increase short-term debt for new product or service development, while initially selling connected products. As the product starts to produce higher gross margins, the increases in R&D spending will shift to the income statement.

Success Stories

- Tesla

- John Deere

The news is filled with stories on autonomous cars. Amazon through its acquisition of Zoox; Uber; Argo working with its key investors Ford and VW; Aurora; Nuro and GM’s Cruise; Motional, Hyundai and Aptiv’s AV joint venture. And, of course, Tesla which is always doing Tesla things.

Autonomous vehicles are a popular example of building technology into a product. So, let’s use an example that may not be so obvious.

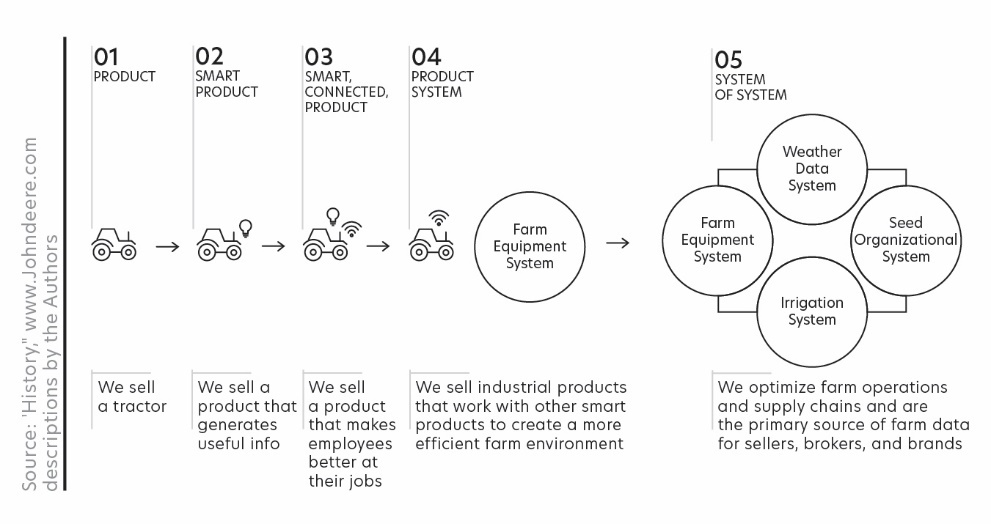

John Deere has been in business since 1837, selling tractors as we know them since 1938.[i] In 1996, the organization began to build sensors into its products. At first, the sensors simply warned whoever was driving the tractor when the gas was low, when the oil needed to be changed, or when another maintenance was necessary. In 2014, capabilities were added that enabled the tractor to be connected to the Internet, integrating technology products (sensors and other technologies) that collect, transfer, store, and analyze data. They began to provide on-the-go yield and moisture readings differentially corrected position information, and yield-mapping capabilities.

As new sensing devices are being developed and embedded, the tractor can sense the amount of water in the soil, or the composition of the ground it rides over. When connected to agriculture systems that have determined which crops are particularly successful growing in that soil, when the environment is ready for planting or, better yet, harvesting, informed choices can be made. (Figure 25)

Eventually, weather data systems, seed optimization systems, and data from irrigation systems can all be integrated with the real-time output from the equipment sensors and systems. The equipment might be leased rather than purchased, eliminating the massive capital investment required today. Information from weather systems may be able to help farmers save crops that might be otherwise lost due to previously unexpected weather. Knowledge systems containing information on best practices concerning the crop in question can be accessed and shared.

Figure 25 Evolution from a product sale to a connected strategy

From massive farming conglomerates to farming small plots of land with boutique products, today’s information gaps can be filled with accurate and timely data. John Deere’s revenue goals include not only selling tractors but also becoming a technology organization that sells data to better ensure successful farming outcomes year after year. While many farmers will laugh at the idea that they need a computer to tell them what to plant or harvest when those who help evolve such a service will eventually be industry disrupters.

The John Deere example shows how an organization can move from today’s product strategy to a connected product strategy, to a platform strategy. Having an evolutionary, or direct, path to a platform strategy is what the Digital Age is all about as we see next.

[i] “History,” John Deere website,