Understanding Disruption Isn’t Hard

Originally published as part of, “The Day Before Digital Transformation” by Phil Perkins and Cheryl Smith

The planning process does not begin at the annual strategic planning meeting or even shortly before. Most of the work for a digital strategy meeting begins months before the meeting takes place. Experience has shown that, with a small (three to four people), experienced team of researchers, preparation typically takes about 60 days before meaningful digital transformation discussions can begin. The research team can be comprised of individuals from inside the organization. But we have found that having outside resources help perform the research, prepare the materials, and assist in leading the discussions at the strategy meeting is invaluable.

Examples of research organizations that provide data that can help identify critical market trends, innovations, customer behaviors, and emerging technologies include: (organizations popular at the time of this writing)

- CBInsights, compiles emerging technology trends and insights, general and customized;

- Tracxn, tracks emerging technology themes across multiple countries and companies in those technology fields;

- Crunchbase, provides company, investor, funding data;

- Mattermark, tracks fast growing companies;

- PitchBook, compiles global private company data, pre- and post- money valuations;

- ZoomInfo, focuses on sales, marketing, account management-related data;

- Clearbit, focuses on marketing data to understand customers and prospects.

NOTE: The authors are not recommending that any of the research companies mentioned throughout the book be involved in your digital transformation efforts. We simply provide examples of the types of resources available to your organization should you choose to include outside support at various points along your journey. To be clear, we have stated that developing a digital transformation vision, strategy, and portfolio are the responsibility of the senior leaders at the organization and cannot, and should not, be outsourced. That said, we have found that getting expert assistance at various points throughout the process may improve the quality of the input data you receive during your discussions and the decision-making process.

Market trends

The macroeconomic trends that are shaping your industry and market are most likely very well-known by the leadership team. Also known will be the impact of regulation and policy issues. But what about the microeconomic trends shaping the industry, and social trends? These areas typically are much less researched and discussed.

Relevant irreversible market trends in the Digital Age are not difficult to identify. For example, the evolving trend in the food industry that concludes that only 20% of people will chose to dine in at a restaurant by 2030 as compared to 95% who did so in 2010 is available through industry research.[i] The fact that by 2030 the US will experience major changes in age, race, and ethnic diversity are well documented by the Census Bureau.[ii] Trends in every industry through 2030 are available through solid research.

The difficulty is not in identifying major irreversible trends. The difficulty is getting the leaders to accept them. But the first step is to identify them from reputable sources.

Competitive threats

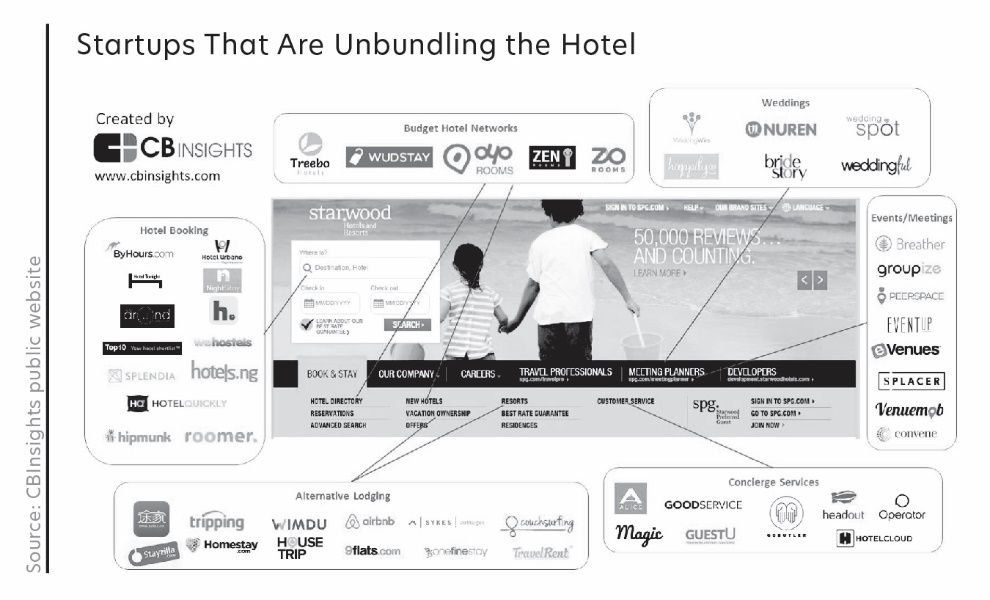

Figure 37 is worth a thousand words to an executive in the hospitality industry.

One glance at this graphic should have been an eye opener for an EVP at Starwood a few years ago. (Starwood Hotels and Resorts was purchased by Marriott International in 2016 and is now Marriott Bonvoy.) The competitors listed were not the usual well-known, well-studied, and frequently discussed Marriott, Hilton, Best Western, Hyatt, and Wyndham chains. This figure identified the organizations attacking the hotel’s products and services from a digital perspective. This is an example from a single industry. Throughout this chapter we provide examples from different industries to demonstrate that the process we describe works for organizations in every industry.

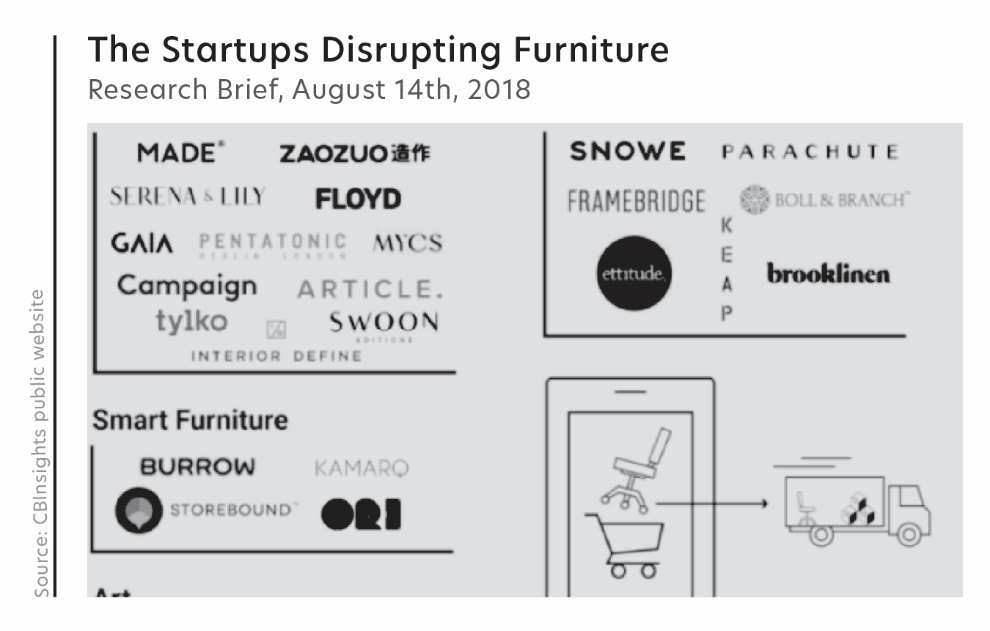

One of the easiest and best starting points to produce a Digital Age competition map is to begin with a screen shot of your website. Performing research on start-ups of all types (Figure 38) that are directly addressing all aspects of your business that are identified on your website is an excellent first step in identifying your digital competitors.

Drilling down on your drop-down menus and identifying additional competitors for lower level activities or products should be your next activity.

Your competitive research begins there. Understanding what each of those organizations do, and how they are doing it, is the real information you are looking for. How big are these organizations (employees, customers, revenue)? What are their core business value propositions? What technologies are they using, and how have they applied them in innovative and creative ways? What differentiates each of them from how you are performing the same activity(ies) and from others in that arena?

After using your website as a starting point, next look at your value chain, i.e., those activities your organization performs to create, deliver, and support the products and services addressed on your website. Most organizations today have maps of the processes that perform their primary operational activities, such as their manufacturing or other core operations, logistics, marketing and sales, call centers and customer support services, as well as their internal support activities such as procurement, human resource management, and technology development and infrastructure. Who are the new players in these areas in your industry? What are the new technologies or concepts or ideas or efficiency or effectiveness changes that should be discussed in your strategy sessions?

Keep in mind that digital transformation is about digitizing your products and services, which involves using the new technologies to make substantive and valuable changes to the way that you do business. Organizations should take a new look at how one or more emerging technologies might be used to make major changes in back end processes. Manufacturers, for example, may need to rethink and reconfigure supply chains, if for no other reason than to take advantage of the continuing evolution of local powerful 3D printing capabilities.

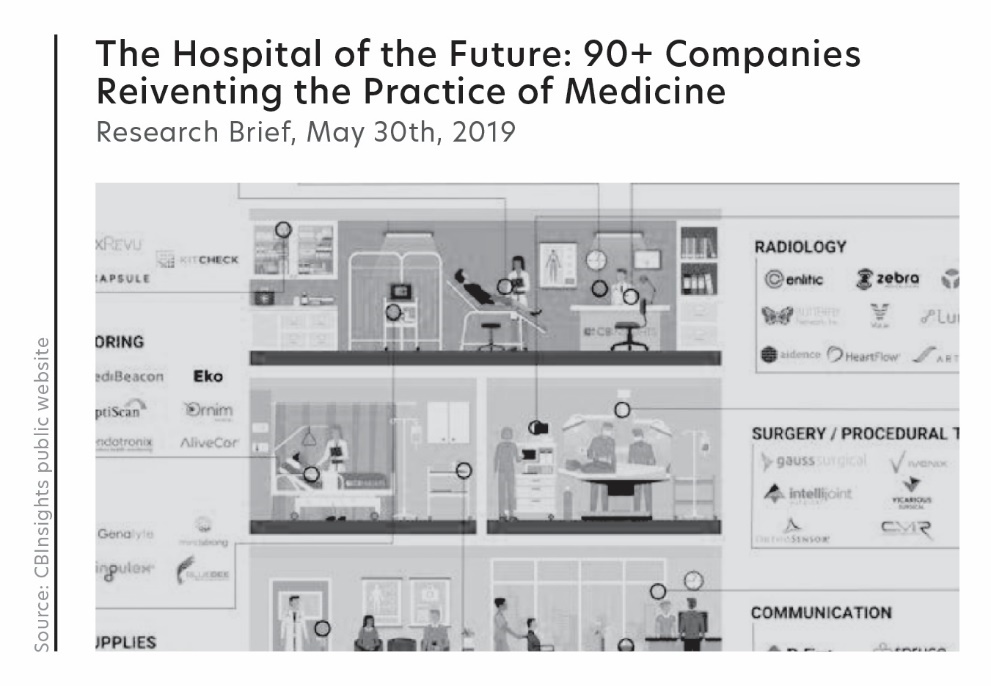

Organizations such as CBInsights have accumulated a tremendous amount of information on technology organizations, including start-ups. Contracting with firms like this saves time and effort in performing and presenting new and up-to-date competitive threats including details about both competitors and start-ups and the technologies both are using. (Figure 39)

Customer behavioral trends

Helping leaders comprehend and internalize the market trends and new digital competitive threats that are in front of them is important but theoretical. If the business is in free-fall, they will be more open to listening to the stories and admonitions in those areas. But if the business has not yet hit a critical juncture, getting leaders’ attention on issues outside the status quo is difficult. The one sure way to get their attention is to describe changes in customers’ (and non-customers’) actions, mindsets, preferences.

All business, whether for-profit, non-profit, or government, is about making bets on human behavior. The goal is to identify the wants, needs, and motivations of both profitable and unprofitable customers. Wants are always openly expressed; needs and motivations are hidden or even unknown to the customers. In addition to connecting with online research organizations, original research may provide your best insights into how your current and targeted customers behave, or might behave, in a digital world.

Many research companies offer big data insights, i.e., insights based on large amounts of data formally collected from a wide array of sources. But understanding how customers will behave in a digital world, from brand awareness to interest to search to purchase decisions to after purchase support expectations, is a new and still highly inaccurate science. Which is why thick data collection efforts often can be as valuable as big data quantitative efforts at this stage in your digital transformation efforts.

Thick data revolves around gathering information from small sample sizes, easy and inexpensive to obtain, to capture unquantifiable insights from actual people—sometimes your current customers, sometimes individuals who are not currently your customers. It involves translating business questions into human questions. Scott Cook, founder of Intuit, called it “follow me home” data, which is exactly what he and the early team did when first selling Quicken commercially. They followed people who bought their product to their homes (with their permission, of course) and watched them install and use their software to get first-hand information on the challenges and successes that resulted. They found in repeated follow me home studies that more customers were using it to run their small businesses because they did not want to learn or pay for someone to do double-entry accounting. That is how QuickBooks was created.

A now famous example helps to explain the value of thick data. A story about thick data was told by Tricia Wang in a September 2016 TEDxCambridge Talk, The human insights missing from big data. Wang held a research position with Nokia in 2009. At the time, Nokia was one of the largest cell phone companies in the world, dominating the emerging markets in China, Mexico, and India. Wang was doing research on how low-income people use technology. She did her fieldwork in China, spending her time in Internet cafes and hanging out with Chinese youth to understand how they were using mobile phones. She saw that even in the urban slum area where she lived, people would spend half of their monthly income to buy an affordable iPhone knock-off. The iPhone had just been introduced in China and was being heavily advertised. As she tracked spending on cell phone bills of her friends and acquaintances, she began to see clearly that a big change was coming—that even the poorest in China would do almost anything to get a smartphone.

She shared her findings with Nokia. They rejected her conclusions because they did not correspond to the millions of data points they had collected via their quantitative research of people wanting to buy a smartphone, particularly not in low income areas in China. Their surveys were designed to optimize their existing business model, not to attempt to predict emergent human wants. Missing the smartphone wave, Nokia’s position in the cell phone market dropped dramatically by 2012. Its stock remains in the $4 range today.

Nokia’s rejection of Wang’s thick data findings is called big data quantification bias.[iii] Understanding what people are thinking and how they are reacting as the Digital Age accelerates its ascent up the S-curve will play a large role in separating the winners from the losers. Thick data studies are a legitimate form of research, particularly at a point when more formal data collection efforts are still inadvertently based on existing business models. Exactly how consumers will react to new digitized products and services is an unknown today. Talking with consumers and observing their behaviors is an excellent way to begin to fill this data gap.

In addition to using thick data as well as quantitative data to uncover customer and non-customer wants, needs, and trends, collecting in-depth information on changing customer behaviors also is found through insights emerging as a result of ethnographic research, social listening, and modeling. A focus on changing customer behaviors can provide early warning signs of disruptive change that may be happening to your organization.

Current employees can be a good source to collect thick data if they are open minded enough to be able to think of, and discuss, insightful questions about customer needs, wants, and preferences. We have found however that it is a rare person who is steeped in and committed to their organization and job who can do that. Outside services may be needed to assist with insightful question formulation, data collection, and materials preparation. When assessing the usual big consulting firms’ capabilities in performing this type of research, and their hands-on experience with the emerging technologies, they have often not proven to be as effective as small firms that specialize in this type of data collection. Helping organizations address options for true innovation and disruption requires a new mindset and new experiences. Industry expertise is a plus but not necessarily required—your leadership brings that experience in large quantities to the process. Indeed, having deep industry expertise may be a detriment when attempting to understand digital age customer behaviors and mindsets.

Existing organization assets

In addition to understanding irreversible trends in your industry or marketplace, new competitors, and what your customers are thinking, it is important to understand the extent of the sunk costs of your current assets, with a particular focus on the data your organization currently collects.

Assets are easy to identify and quantify. A simple list of your largest investments in capital inventory is an excellent reminder of what is at stake in developing your digital strategy. Do you attempt to develop your digital strategy around those assets, or do you find that you are developing your strategy despite prior investments? While existing assets and major prior investments cannot be permanently ignored, your leadership team might make a conscious decision to create your digital strategy in a completely different direction. However, in our experience that has not proven to be the best approach. A stronger starting point is to know the exact status of your current assets and investments, and at least begin the thinking process as to how to leverage them.

The status of your IT infrastructure also is important to know at the outset. How many of the early digital technologies have been implemented at the organization? (See Figure 49 in Chapter 8 for a list of the early digital technologies.) What is the extent of the infrastructure base you already have in place upon which emerging technologies can be built on and launched? You might find that your strategy will require an investment in IT infrastructure in addition to your product and service digitization efforts.

Focusing on data as a key resource is a basic tenet in the Digital Age. Winning, even organization survival, is dependent on establishing a culture based on understanding and living that principle. Today’s successful organizations know that when machines and algorithms are deployed against the vast amounts of data that an organization already collects, high-value insights are produced that can be, and often are, organization and industry transforming. People looking for patterns in the data collected have been key to organization successes in the past. But an individual’s efforts cannot begin to compare with insights produced using today’s analytic, machine learning, and AI technologies.

One of the early preparation activities that an organization serious about digital transformation must do is to find and organize the data it already has and continues to collect. Every organization collects a massive amount of data. It is typically used for one purpose, for whatever reason it was collected, and then stored somewhere in the archives. This data is referred to today as data exhaust—it is collected, used once, then it disappears from the organization. But data is incredibly valuable as we have discussed in Chapter 5: Digital leaders put data at the center.

Knowing your organization’s data begins here in the strategy preparation process, if not long before. This effort entails documenting how, when, and where each piece of data is collected and stored. Today’s technologies can store just about any type of data, from pristine to messy, in a searchable format. Clean data is a bonus, and efforts to make data more readable have shown substantial payback. But simply documenting what you have and where it is located is a big step forward.

Once an organization has a solid grasp on data that it automatically collects, leadership discussions can include how to use it to improve operations or increase the customer base or revenues. Discussions can also occur about additional data that could prove to be of value to the strategy. As you form your digital strategy you may decide to invest in collecting even more data in certain areas. Many digitally successful organizations invest preemptively to collect more data faster than competitors. For example, one of the main reasons Microsoft paid $2.5 billion for the video game Minecraft in 2014 had little to do with the actual revenues of Minecraft ($330 million in 2013). It was the customer base and consumer data it possessed that Microsoft was after.[iv]

Many external lists for data relevant to your organization are already known. For example, information generated by customers on social media about your brand, your organization, your products and services, competitors and their products and services, the industry, your promotions, events, and business practices has proven to provide exceptional insights to your organization. This data can be obtained both proactively (by self-monitoring key words that appear on specific sites—sometimes for a fee) and reactively (by paying sites to monitor key words for you and send you the results).

Social media data about your organization is only one example of collecting data from outside the organization on a regular basis. Investing to capture the maximum volume of data in carefully selected areas determined to be potentially critical to your strategy, from the broadest set of sources, even if sustaining losses in the near term, also has been proven to be a factor at successful digital organizations. These data investment and collection areas are not performed randomly, of course, and these data efforts typically are iterative: first, they may help to identify directions in which the strategy should go, and second, other data needs may be identified when the digital transformation strategy is established.

There are a few additional lessons on data that organizations with successful digital transformation strategies and programs have learned. For example, there are risks in addressing data exhaust that can lead to big data issues within an organization because not all data created is equal. The term big data itself is a relative term, essentially meaning sets of data that are so large or so complex or both that traditional IT hardware and software has trouble dealing with it. Big data challenges include collecting, storing, searching, analyzing, and sharing it. Data sets can grow rapidly today because they are increasingly added to by Internet of Things devices that are cheap and numerous, such as mobile devices, wireless sensing devices, cameras and microphones, radio-frequency identification (RFID) readers, software logs, etc.

Successful digital organizations are thoughtful and deliberate about the data they choose to collect and maintain because it takes resources to do so—substantial amounts of time, money, and technology. Collecting data that is not effectively used results in that data becoming a liability rather than an asset due to incurring the associated costs with none of the benefits.

Also, organizations that have successfully transformed have learned how and to whom to sell their data. They leverage commercial terms to make B2B, in some instances B2C, customers pay for insights. In other cases, they sell details about customers and their actions. Selling data that your organization has collected and invested in is one aspect of a digital transformation strategy that needs to be included in the strategy discussions. However, privacy regulations are being put in place in many parts of the world. The two best known data privacy regulations are Europe’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These and similar data privacy laws and regulations have consumer opt-in requirements that are critical to get right to effectively pursue data sales as part of your digital transformation strategy. But the legal and ethical sale of data is and will continue to be a core advantage and source of future revenue at successful digital organizations.

Careful thought must be put into the sale of data not only because of privacy regulations but also because there is a cost associated with its sale. Data requires effort to turn it into something valuable that can be accessed. It takes time, effort, and dollars to make the data in your organization readily accessible in a way that is resilient, performant, scalable, secure, and compliant, so these realities need to be built into the strategy.

Organizations have a constantly expanding set of responsibilities with respect to their data. The features described above are not easy to build in after the fact, so they need to be built directly into your core data and interface layers. Doing this as a standard practice gives you significant leverage in doing it properly across the organization. As your organization transitions from having a small percentage of its data available through interfaces to a large percentage of its data being available through interfaces, it has a dramatic effect on the increased pace of innovation.

The data must be professionally designed, stored, and accessed using the early Digital Age technologies, which is another reason to understand the status of the IT infrastructure. Imagine that someone on your team has an idea to build a mobile app for a small customer segment that could be very impactful in making the customer sticky and in attracting new customers in that area. If they need to go to five different organizational units to get both approvals and interfaces to multiple systems to retrieve the data needed, it can quickly become a large initiative requiring multi-departmental support, budgeting, and resource allocation. Too often this results in either significant and costly delay or the innovation getting abandoned completely.

But the benefits of doing data right in the Digital Age are enormous. As the amount and easy accessibility of data scales, three things start happening:

- Higher gross margins on successful digital solutions because they are reusing existing assets.

- Lower cost of delay due to data being readily accessible within organizational guidelines.

- Lower capital expenditure on innovation as each team can increasingly innovate within its silos.

The more data that is readily available to everyone, the more innovative your teams can be with the data. While there is a cost associated with a data strategy, the benefits associated with expertly designed and implemented data strategies pay themselves back in dividends many times over, a major benefit being more effective and timely business decisions.

Relevant emerging technologies

Finally, pre-meeting preparation activities must include research into at least a few select emerging technologies. (See figure 50 in Chapter 8 for a list of emerging digital technologies.) While the exact technologies that will be of primary interest to the leaders will be based on the digital strategy developed, obvious choices emerge when doing research on the competitors that are attacking your product and service offerings and your value chain. Highlighting those technologies and explaining, in plain language, what they are and how they work, is important because they will be part of the strategy discussion.

Collecting information on the emerging technologies that are beginning to play a role in your industry can be done in several ways.

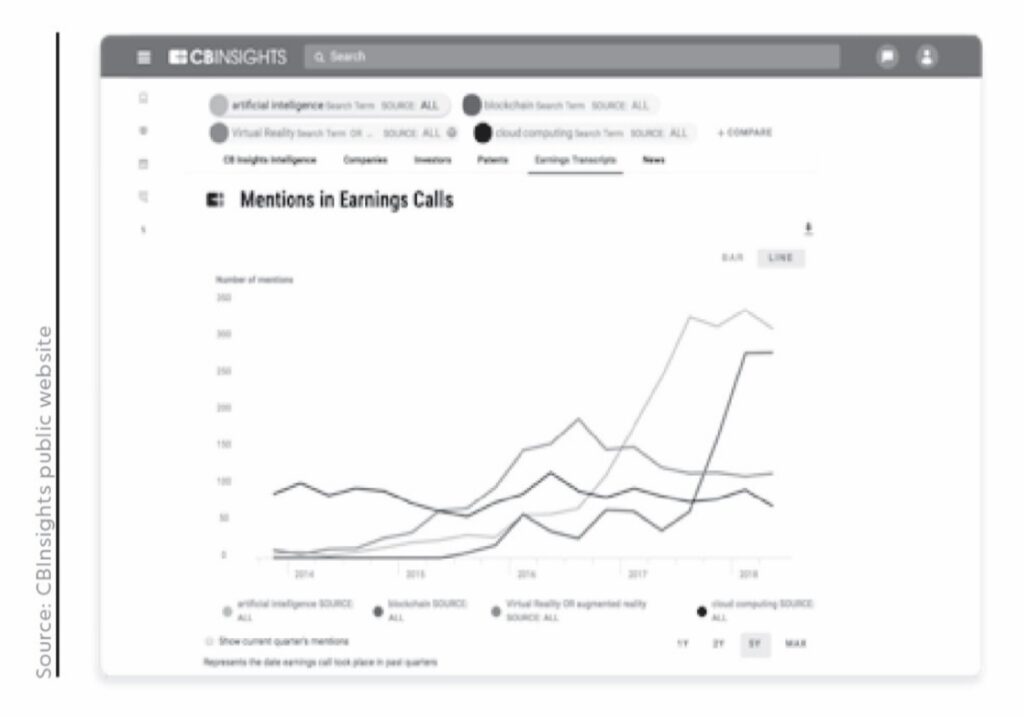

For example, a graphic analysis of your major competitors’ earnings transcripts may provide useful information. Would it be interesting to know how many times various digital technologies have been mentioned in your competitors’ earnings calls over the past year or two years or five years? (Figure 40) And how that compares with mentions on your earnings calls? While such an analysis does not tell you exactly what is happening, it does give you an idea of which digital technologies are under serious consideration within your industry.

Research into the underlying digital technologies inherent in the products and services being offered by third parties helps to identify which digital technologies the technology vendors believe are most applicable and are selling into your industry. (Figure 41)

Information about the technology organizations that are focusing on various industries today is being captured and updated regularly by various research organizations such as previously mentioned. Examples we offer here include the HVAC marketplace, and the construction and education industries. (Figure 42)

Research also is available that identifies new business relationships that are being established between technology organizations and your industry. An assessment of relationships such as these helps to identify which functions technology vendors believe their products are most relevant to. (Figure 43)

We have found that it is helpful to have at least one emerging technology expert in the room during the meeting. He or she can provide critical support in helping to guide the discussion for parts of the strategy. This expert can provide the leadership team descriptions of how various technologies would support, as well as augment, the vision and strategies that are being discussed. For example, if there are one or two emerging technologies that support many of the product or service strategies under consideration, those technologies may become a defining strategy factor.

Regardless of who performs the research, news, unfiltered, unbiased data needs to be included in the pre-meeting package, on trends, competition, customers, and digital technologies. These materials should present both the raw findings from the research in each of those areas as well as any common themes that came to light. The leaders attending the sessions are industry and product/service experts and will be able to understand what is being presented, particularly if some level of analysis has gone into finding and identifying common themes.

The researchers must keep in mind that the purpose of performing this research is not to draw conclusions or present recommendations. The purpose is to provide the leadership team with information they have not seen or thought about before, at least not in a coordinated, consistent way. Attempting to lead them to predetermined conclusions will not be effective if the goal is to have the leaders commit to embracing a digital transformation vision and strategy.

Once the leaders have had a chance to review and become familiar with the pre-meeting materials that have offered a better understanding of the disruption that is going on in the industry and marketplace, the status of your organization today within that context, and the potential unique capabilities and solutions emerging technologies have to offer, it is time to hold the meeting.

[i] Presentation at the Digital Value Institute, Lou Grande, CIO, Red Lobster, November 13, 2019.

[ii] “Demographic Turning Points for the United States: Population Projections for 2020 to 2060,” Jonathan Vespa, David M. Armstrong, Lauren Medina, Report Number P25-1144, February 2020.

[iii] Dozens of scientific articles on big data quantification bias available through a google search using those words.

http://scholar.google.com/scholar?q=big+data+quantification+bias&hl=en&as_sdt=0&as_vis=1&oi=scholart.

[iv] “Here’s Why Microsoft Is Paying $2.5 Billion For Minecraft,” Jay Yarow, Business Insider, September 15, 2014.