Transformation #2 Of 4: Support Systems

This transformation strategy focuses on building a digital ecosystem around a product or service to dramatically reduce costs or substantively improve the efficiency and effectiveness of operations. Organizations that pursue this strategy develop deep expertise in the data or the processes or both that support the product or service delivery lifecycle, with limited changes to the product. (Figure 21)

As with the Deep Customer Engagement strategy, the organization does not change its core product in this strategy, it focuses on maintaining product parity. The differentiation for end customers is in the efficiency of doing business together. Organizations selecting this type of transformation will become a strategic partner to customers by providing them efficiency and value-added insights that help them directly, or if they are middlemen, help them become more effective at servicing their end customers.

In this digital transformation strategy, the channel strategy will typically involve a combination of direct and indirect, but the most successful (and profitable) strategies are direct channels. Leaders will create a symbiotic relationship with partners while incentivizing their most loyal customers to interact directly with the organization’s own digital channels.

This strategy increasingly pushes the business models toward ‘outcome-based’ models that shift the organization’s focus from the product or service they create to what their customer is really looking for: a frictionless solution to their problem, i.e., an outcome.

- Most organizations establish loyalty programs that include rebates, discounts, cash, or points earned toward products or services.

- Auto-replenishment drives sales, increases loyalty, and enables organizations to track inventory and usage accurately and automatically. For business-to-business (B2B) organizations, negotiating long-term contracts with vendors and partners in exchange for discounts can enable organizations to amortize CapEx investments over multiple years.

- Some organizations evolve their pricing strategy to add subscription-based revenue for their most loyal customers, like the energy companies do that charge a flat estimated monthly fee to smooth out differences in energy costs between the winter and summer months.

Early success metrics include maintaining users and customers on the organization’s delivery systems for as long as possible. Because it is difficult to differentiate on the core product, it is important to differentiate the experience of working with the organization. Because online reviews have become prevalent, it is important to deliver a wonderful experience around the product, which means extra attention to customer service and satisfaction.

The industries most likely to adopt this type of strategy include grocery, energy, transportation, hotels, airlines, manufacturing, and construction because they usually have the following things in common:

- Very low margins that make it nearly impossible to change the cost of goods sold or bill of materials (BOM) for the product. In many cases, these products or services are nearly a commodity. The product or service may have higher margins if it has intellectual property protection.

- Low margins that require extremely high volumes to achieve the profitability necessary to overcome investments in manufacturing, warehousing, and distribution costs.

- Because the product or service is nearly a commodity, competitors cannot differentiate using variants. Differentiation is typically either driven by product or service quality or forced by intellectual property protection.

- Low margins that give significant advantages to those organizations that can achieve scale, which leads to few large market share holders.

- Due to the advantages of scale, customer churn tends to be lower, which allows the organization to make higher capital investments in service to those customers.

In this strategy, it is critical to focus on data about the product or service delivery lifecycles, such as insights on customer consumption behaviors, end-to-end supply chain lifecycles, market suppliers, end-to-end manufacturing processes, inventory management, and distribution.

The emerging technologies that are most likely to be impactful in this type of strategy must either automate a physical process or collect data on the product or service both from the inside out (data about the operations themselves) and the outside in (from the customer’s perspective).

- Basic data analytics, when correctly and continually incorporated into day-to-day operations, is what is typically needed.

- Radio-frequency identification (RFID) is entering maturity and is a technology that must be considered in any support system transformation strategy.

- Sensors can be added to every aspect of the supply chain. It will be critical to work with partners to drive sensors into many components of the supply.

- Use of drones and other autonomous vehicles within the operational environments involved is becoming important as these technologies mature. Instant delivery is an increasingly important differentiator for delivering on the convenience end customers expect.

- Support systems that are generally supported by significant automation will remove manual labor and streamline efficiency.

- 3-D printing is replacing heavy investment manufacturing requirements for as-needed, on-the-spot part replacement. This lowers overall product or service costs and improves customer satisfaction.

- Many organizations are using machine learning and AI to perform quality control checks.

- Advanced support system strategies increasingly leverage virtual reality (VR) and augmented reality (AR) capabilities for training, preventative maintenance, and inventory management, but are also considering these technologies for creative customer interactions.

Organizations using this approach should primarily look to create massive cost savings to contribute directly to the bottom line or, more importantly at the outset of the efforts, to be redeployed into R&D activities. Some revenue increases will be driven by delivering more efficiency, choice, and value into the system. There will typically be a short-term increase in expenses related to the amortization of assets added to the balance sheet to support the transformation. Organizations using this strategy should see an increase in technology capital expenditures (sensors, robotics, other devices as well as software).

For organizations with a traditional CAPEX approach, the ROI to justify emerging technology deployment is usually dependent on multiple new value propositions. Organizations choosing this strategy often need to invest in technologies that lay the foundation for future value propositions. Funding requests will typically require using an investment model rather than today’s traditional business case model.

Organizations that rely heavily on a traditional OPEX approach must choose this strategy with caution because their balance sheets may not be able to support the needed physical infrastructure investments. Because these costs are typically below the line, they cannot be supported by traditional inventory financing credit instruments.

Success Stories

- McKesson

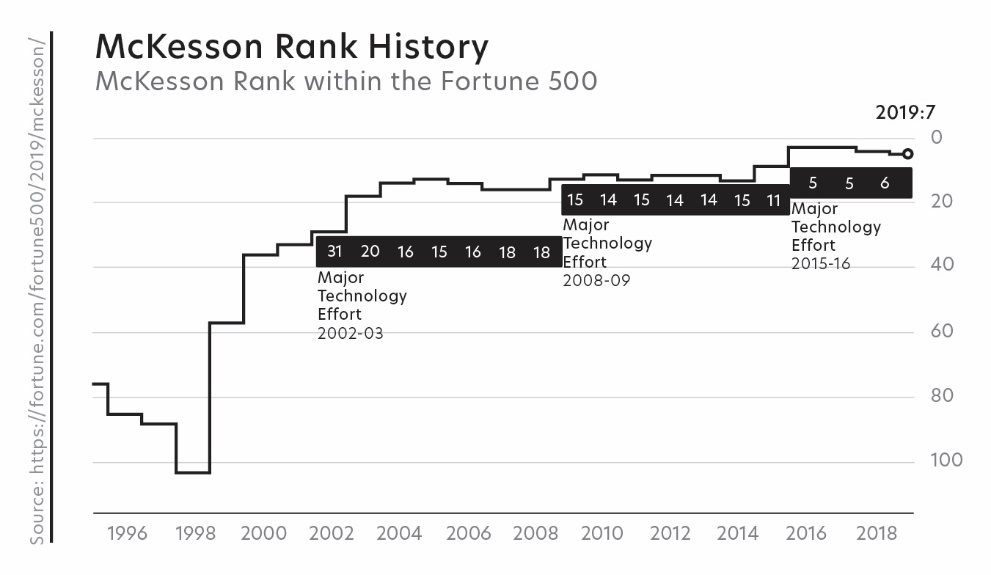

McKesson is primarily a pharmaceutical and medical-surgical supply distribution company (93% of its revenue is from its distribution business). The operations surrounding its pharma business have undergone a major technology refresh every 6 to 7 years since 2002. The company’s Fortune rank consistently has risen to a new level every 6 to 7 years.[i] (Figure 22) There are many reasons that contribute to leaps such as these, of course, but technology played a key role. (The CEO was the same throughout the years shown.)

McKesson ships close to $200B of product annually. The company has no direct control over the products it ships (other than the brands and products it decides to contractually distribute), so its digital strategy is to concentrate on its support systems.

McKesson implemented many of the early digital technologies in 2002-2003, of which three were key to assisting the company in making its first leap into the Fortune 20—and staying there:

- Enterprise Resource Planning (ERP)- system selection and implementation. The Pharma division chose SAP to manage its operations. Since Pharma was the major revenue generator for the company, the decision was made to set up the financials companywide, including the Chart of Accounts, to ensure ease of purchasing, inventory, supplier files, customer files, payables, receivables—all activities that supported the Pharma operations. At the time, McKesson shipped about $300M in inventory each night throughout the US, Canada, and Mexico. The McKesson SAP system was the largest implementation in the US at the time in terms of numbers of transactions processed per day. The implementation of SAP was a major support to the business and finance operations.

- Internet. The company also took advantage of the Internet capabilities available at that time. An online ordering system was developed for the customer base. $3B in orders were processed via the online system in the first year of operation. Over the next decade, this rose to well over $120B annually.

- Wireless broadband. By 2002 McKesson operated consolidated warehousing operations. Products would be sent by suppliers to 31 major warehouses across the US. The products would be shipped each night throughout the US from those warehouses. Wireless broadband was introduced at each warehouse that enabled automated pick, pack, and shipping capabilities to be implemented.

The technology refresh that helped to support the second leap took place in the 2008-2009 timeframe.

- Major upgrades were made to take advantage of newer versions of SAP, which enabled smooth consolidation of corporate acquisitions McKesson made and helped to account for major portions of the synergies.

- Voice over Internet Protocol (VoIP) technology was introduced into the call center operations, which enabled the call center to be located any-where within the US as well as offshore.

- Capabilities from Cisco were implemented to enable video conferencing throughout the McKesson offices, which were spread across the US, Canada, Mexico, and now Europe.

- Server farms were used to virtualize data center operations, and data centers were consolidated throughout the organization, further supporting the corporate acquisition efforts.

- The telecommunications capabilities within the warehouses were upgraded to match the speeds of the new capabilities that were then available.

By May 2009 experience with warehouse automation and upgrades enabled McKesson to win the contract to build a new, dedicated, temperature-controlled warehouse to receive and distribute 160 million doses of the vaccine to combat the H1N1 virus, the Swine Flu. The warehouse was completed in four months, in time for the first doses to be distributed in October 2009. More than 100 million doses of the vaccine were distributed from that warehouse enabling McKesson’s regular daily distribution operations not to be impacted.

Technology upgrades also played a major role in the third leap in the 2014-2016 timeframe. The IT infrastructure was moved to full cloud capabilities. RFID began to be implemented to ensure chain of custody of the pharma products, from manufacturing to point of sale. Data became a focus for the company.

Most importantly during that time, there was a major emphasis on cybersecurity. McKesson operations are governed not only by the technology security regulations but also by HIPAA. The Health Insurance Portability and Accountability Act (HIPAA) was passed in 1996. Basically, HIPAA requires healthcare organizations to keep patient data safe by exercising best practices in three areas: administrative, physical security, and technical security. Actions are taken every year to ensure McKesson compliance in all three areas, but cybersecurity threats were raised to new levels in the 2014 timeframe. Any type of breach would have caused major damage to the company—both reputational and financial. Never having a breach helped the firm move into the top ranks of the Fortune list—and stay there.

McKesson’s overarching technology principle is simple: do not implement bleeding edge technologies—wait until they are tested and stable. But make sure that the company is the first in the industry to incorporate them into their products, services, and ways of doing business.[ii]

- WestJet

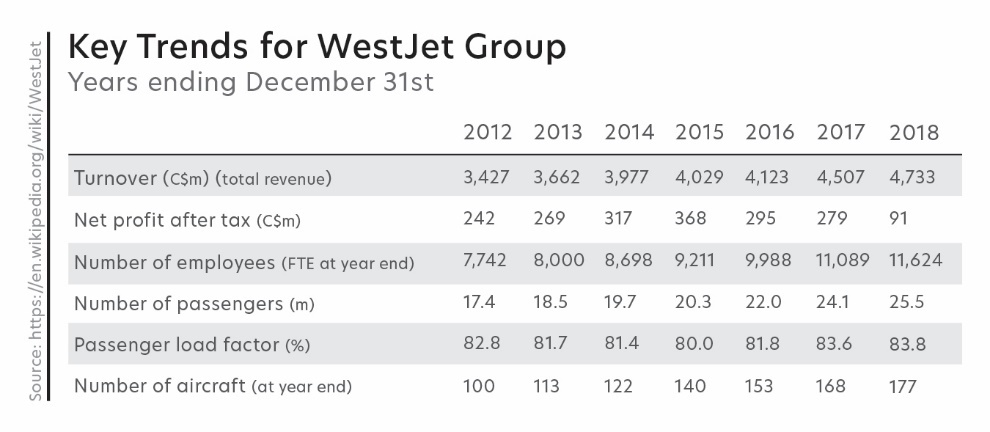

WestJet is Canada’s second largest airline whose major competitor is Air Canada. WestJet began as a low-cost budget airline priced for vacation flights to cities in Western Canada and California, and was privately funded with a purchase of three airplanes. The first flights took place in February 1996. The company grew by successfully incorporating digital technologies throughout its operations from its inception. (Figure 23)

While the airline had always depended heavily on technology to support its expansion, WestJet underwent a major technology upgrade beginning in 2010. A new CEO was hired in April 2010 and served as CEO until March 2018. His numbers are impressive as can be seen in Figure 23. However, he received substantial help from the early digital technologies throughout his time at the company. The technologies not only addressed the specific challenges facing any airline, the solid technology infrastructure base that was created enabled the company to respond to opportunities to grow exponentially, such as quickly expanding (108 bases in 25 countries), and starting affiliated and subsidiary airlines to address specific markets (Encore, Link, and Swoop) by reusing the technologies that kept quality across all operations high and administrative and overhead costs low.[iv] This is what they did:

WestJet cut over to Sabre to use as its base reservation system in 2010. That cutover enabled the airline to join alliances with other airlines to codeshare, i.e., use airline partners to offer continuation flights to and from cities where WestJet did not have a base. Moving from a homegrown system to a core supported by an outsourcer was a difficult undertaking. But once completed, all other systems could be built on top of it. (Sabre was developed in the 1960s and much of the original code is still at its core. It provides business value but also substantial challenges to digitization.)

Beginning in February 2011 and continuing for the next two years, the IT team implemented most of the early digital technologies that were by that time mature: an Enterprise Service Bus (Data Power from IBM) as its internal core application data exchange capability, with APIs for seamless links to its core partners Sabre and its external travel agents. It implemented a private cloud infrastructure including redundant data centers in Calgary and Toronto (HP server farms running VMware, Cisco routers, EMC disk, F5), ensuring that the critical flight, maintenance, and reservations systems were supported in-house and had built-in real-time redundancy. Other early digital technologies that became an integral part of the infrastructure included: Content Management (Autonomy), Data Management (Oracle’s Exadata), Enterprise Resource Planning (JD Edwards), Identity Management (Tivoli from IBM), Notification systems (ODM from Oracle with iLog), PCI compliance (Token Broker from Intel), automated QA/Test systems (multiple software packages for multiple sets of software), Sales and Marketing (Siebel for the Frequent Flyer Program), private Google search capabilities for the WestJet website, and secure wireless broadband throughout the buildings and maintenance facilities.

Mobile apps for the reservation and change activities, gate change notifications, employee activities, etc., were built on top of the infrastructure. Voice over IP (Avaya VoIP and Interactive Voice Response) enabled over 900 call center agents to permanently work from home by 2013, improving service levels, reducing physical location costs, and opening hiring opportunities across the country to support Canada’s multiple languages. That same system became the core of the airline operations communications systems, between the pilots in the air, the operations control staff, the maintenance crews, and the company’s day-to-day telephone system.

By 2013 WestJet had bases established at 85 airports around the world. That year WestJet joined the Toronto Stock Exchange (TSX). In June 2013 it launched the first of its specialty airlines, a regional airline (WestJet Encore), that piggybacked on the infrastructure and applications from the parent airline where permitted by regulation.

That also was the year that technologists from WestJet gave the opening presentations at the IBM, Oracle, and VMware global annual conferences. Such early Digital Age technology implementation efforts require 2 to 3 years to deploy and provide measurable value for an additional 5 to 7 years.

As with any organization, there are multiple reasons for how and why they grow, but the WestJet implementation of the early digital technologies in 2010—2013 was a core contributor to its success. To achieve the next level of success, the airline should be investigating how to lead industry disruption by incorporating emerging technologies into its customer-facing operations, supply chain, and behind-the-scenes airplane maintenance. Incorporating virtual reality technologies at its airports to check-in their passengers and show them to their gates and for its maintenance teams to help them visualize the airplane components and what jobs need to be performed are two obvious examples.

[i] “McKesson,” www.fortune.com, 2019.

[ii] Information provided by Cheryl Smith, McKesson Global CIO, 2002-2005, and Randy Spratt, Global CIO, 2005-2015.

[iii] WestJet, www.en.wikipedia.org/wiki/westjet.

[iv] The authors refer to these opportunities as happy surprises, as in providing support to McKesson’s ability to win a major warehouse contract to distribute a vaccine in response to a pandemic, which they did in 2009 and did again in 2020. WestJet was able to quickly expand (108 bases in 25 countries), and start affiliated and subsidiary airlines (Encore, Link, and Swoop), all while keeping their administrative and overhead costs low.