Do Not Lose the Customer Relationship

If you are partnered with a company that owns the customer relationship, only one of you will thrive. HINT: It’s not you.

Many organizations opt to collaborate with digital upstarts to reap benefits like new revenue sources or solutions to existing problems. However, this relationship often has a poison pill that repeats itself over time. As the disruptor gains enough consumer attention, they begin to dominate the relationship with the consumer, potentially leading to a shift in power dynamics that can harm the established organization.

Let’s look at some examples in detail.

Travel and Hospitality

When Expedia, Travelocity, and Orbitz were introduced to the travel industry they were welcomed as new travel agents that would sell more flights and hotel rooms. And they did. But it was soon realized that they also commoditized every airline and hotel provider. When consumers had full price transparency, airlines and hotels struggled to provide sufficient differentiation. Consumers quickly showed that the determining factor in travel-related choices was the price. Airlines were faced with the challenge of being more than tubes in the air. This idea of existing airline and hotel operators pricing out customers opened the door for no-frills start-ups such as Frontier Airlines and Airbnb that could undercut their larger competitors on price.

At its start, Airbnb offered customers the option to sleep in a stranger’s spare room for a low price. Customers that were attracted to this option were not the same people attracted to Hilton and Marriott. But over time, Airbnb’s success allowed them to increase the selection and quality of their offering to cater to higher-value customers, all without owning a property or managing employees on properties. Now Hilton and Marriott are struggling to compete with their asset-heavy business models, while Airbnb is growing rapidly.

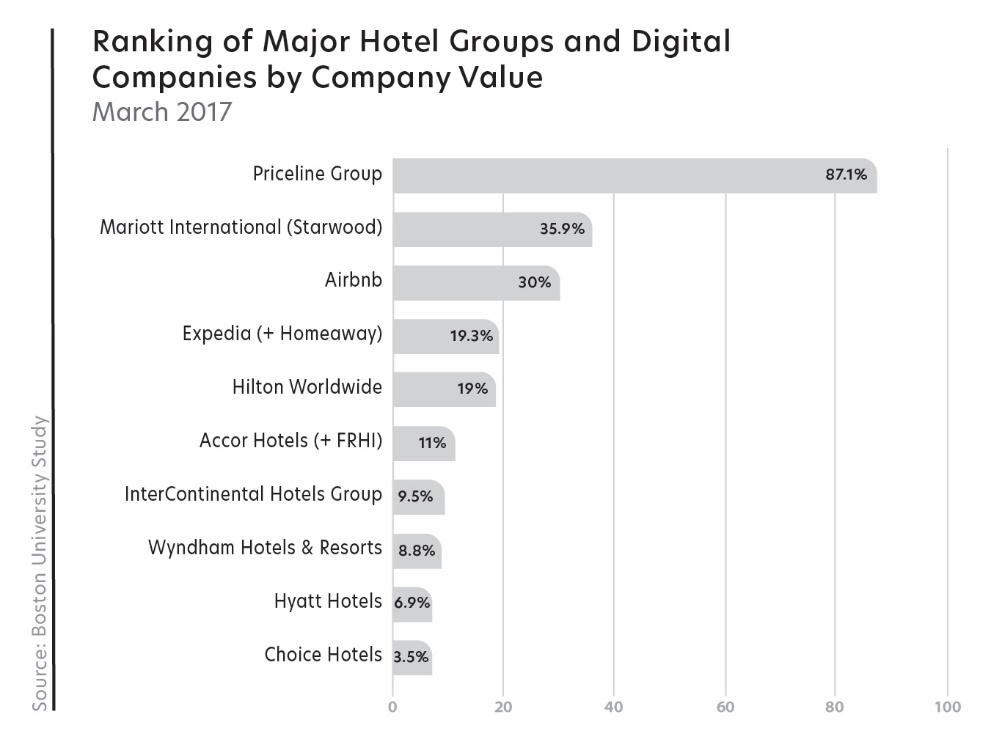

A 2018 study by Boston University shows that since Airbnb’s inception in 2008, annual occupancy rates, revenue per available room, and average daily rates were all down by an average 2 to 2.5 percent across 10 major US hotel markets. [i] (Figure 13)

Retail

Amazon and other eCommerce leaders have been slowly eroding every aspect of traditional retail by providing greater choice, value, and personalization. The introduction of mobile had the same impact on retail as the web did for travel. Consumers standing in front of a product at a retail store could now pull out their phones to instantly check product reviews and pricing to decide if they were getting the best possible value. With leading eCommerce providers providing free shipping and 1-day delivery, consumers were increasingly willing to shift the commerce decisions to mobile. Retail locations became little more than showrooms. Consumers could evaluate the product at the retailer’s location, then spend with the eCommerce provider that provided the lowest cost or fastest shipping.

A 2017 study showed that mobile’s effect on retail shopping not only drove price sensitivity, but also showed that consumers using mobile technology in-store make fewer impulse purchases, fail to make more planned purchases, and have reduced a shopper’s ability to recall in-store marketing – resulting in wasted marketing spend lower in-store engagement, and reduced average order size.[iii]

Grocery

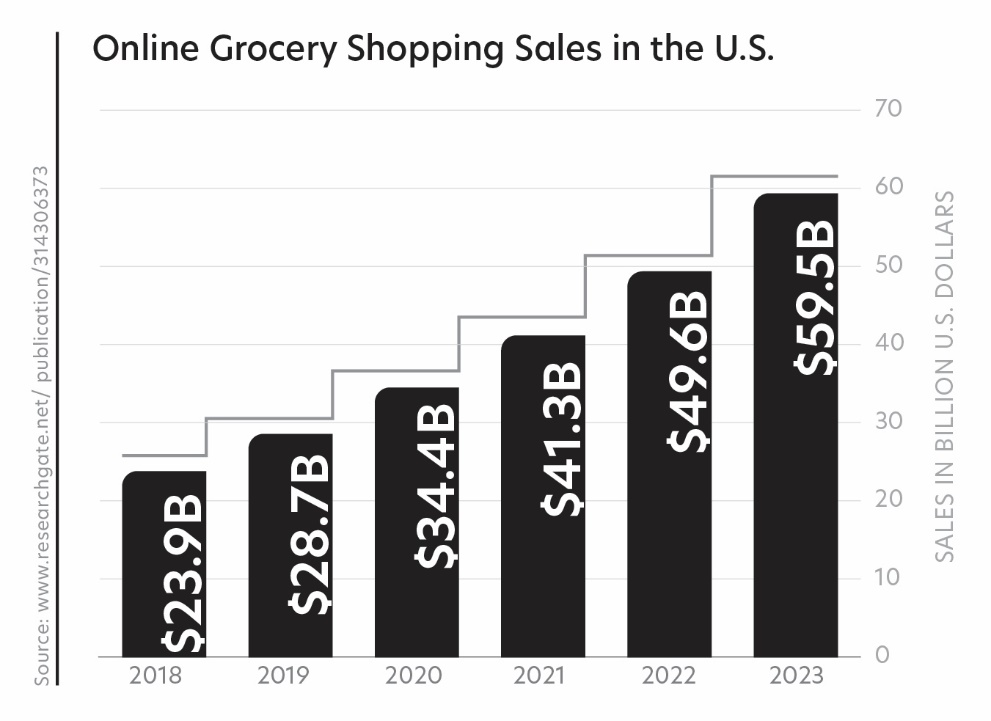

High frequency, low price retailers such as grocers have been able to avoid this disruption, but they are increasingly under pressure as instant delivery capabilities mature. During the pandemic, instant delivery looked positive for grocers because it drove revenue to their stores. As traffic continues to shift from in-store traffic to online orders, which it is projected to continue doing over time,[iv] upstart competitors focusing solely on meeting the demands of online delivery service are unencumbered by the investments of legacy grocers. No cashiers, no greeters, no investments in the shopping experience. With online grocery shopping showing no signs of slowing down and most grocers having little more than a 2% margin, it will not take a significant shift to virtual grocers before traditional grocers start to struggle to cover their lease obligations.

Using data analytics provided by digital platforms such as Instacart and Shipt,[v] the virtual grocer with no consumer storefront can focus its R&D investments on emerging technologies, such as robotic automation and self-driving vehicles to build highly streamlined supply chains directly to the homes of consumers. (Figure 14)

Amazon’s purchase of Whole Foods shows that the noose is starting to close around retailers as digital companies are starting to buy up select asset-based businesses. Amazon’s expansion into the groceries segment reflects a strategy that combines Amazon’s understanding of online customer behavior with new data about customer habits in physical stores. Together, these sources of insights will enable the company to test pricing points, introduce new products and services, improve customer experience, and use those insights to grow the market for health foods, pet foods, and beyond.

Restaurants

The restaurant industry faced major changes that were forced upon them during the pandemic, but many of those changes were already coming and will not disappear. Even before the pandemic restaurants were experiencing the trends shown in Figure 15:[vi]

Restaurateurs were puzzled by the steady movement out of on-premise dining, but the trend was undeniable. Those we spoke to in 2019 had a difficult time imagining what the future would hold. When the pandemic hit, many components of the future became clearer.

But they learned that extensive use of third-party digital platform delivery services is unsustainable. The fees charged by all meal delivery services are high: “typically 20 to 30 percent per order,” sometimes more.[vii] Delivery fees were often harmful to restaurants even in better times, but the volumes were low. Then the pandemic hit, and the volume became close to 100%. GrubHub’s fees easily totaled more than a third of the pre-tax total, by their own calculations. Several cities such as Los Angeles and New York City began legislation to put limits on the delivery fees. But depending on the limits (LA passed 15%), the delivery companies stated that they were unable to make the business work.[viii] Restaurants realized that they needed to handle their own deliveries or rethink their entire business model.

[i] “Ranking of Major Hotel Groups and Digital Companies by Company Value,” Boston University study, March 2017.

[ii] “Ranking of Major Hotel Groups and Digital Companies by Company Value,” Boston University study, March 2017.

[iii] “The Impact of Mobile Device Use on Shopper Behaviour in Store: An Empirical Research on Grocery Retailing,” Silvia Bellini, Simone Aiolfi, International Business Research, 2017, 58.

[iv] “Online grocery shopping sales in the United States from 2018 to 2023,” Jan Conway, www.statista.com, January 13, 2020.

[v] “Online grocery shopping sales in the United States from 2018 to 2023,” Jan Conway, www.statista.com, January 13, 2020.

[vi] Presentation at the Digital Value Institute, Lou Grande, CIO, Red Lobster, November 13, 2019.

[vii] “GrubHub/Seamless’s pandemic initiatives are predatory and exploitative, and it is time to stop using them,” Jon Evans, www.techcrunch.com, April 5, 2020. https://techcrunch.com/2020/04/05/its-time-to-stop-using-grubhub-seamless-forever/.

[viii] “Restaurants Are Desperate — But You May Not Be Helping When You Use Delivery Apps,” Bobby Allyn, NPR, May 14, 2020.