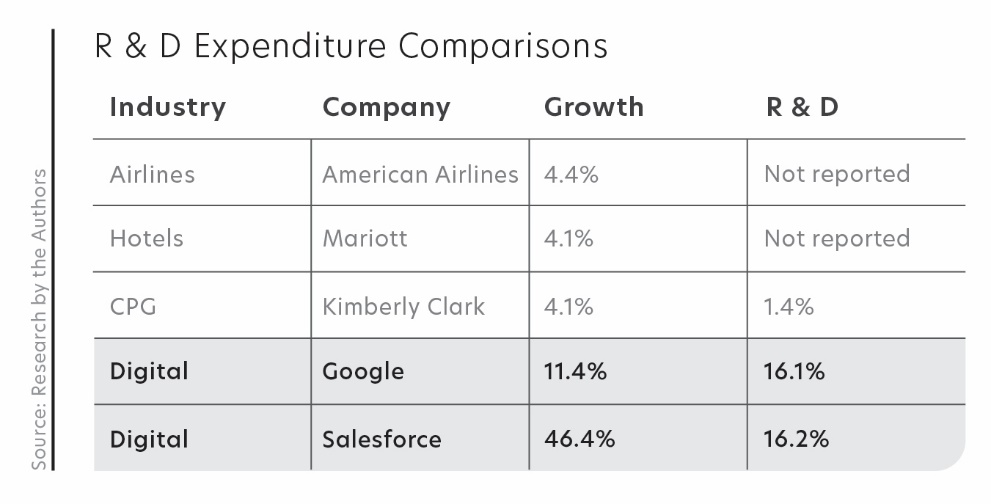

Digital Leaders Spend 5 Times More On Growth & R&D

In today’s digital era, businesses must embrace the benefits of digital revenue models to stay ahead of the competition. This blog post will discuss how digital companies leverage increased gross margins and lower capital intensity to invest in growth activities, and how traditional companies can learn from this approach to create new opportunities in a digitally transformed future.

The Power of Digital Revenue Models

Digital revenue models offer significantly higher gross margins, providing companies with more resources to invest in growth activities such as market research and R&D for new exponential growth opportunities. Many traditional companies have already achieved scale with their core offerings, so they often underinvest in R&D and sales and marketing to capture new market opportunities. To succeed in the digital future, these companies must create new growth opportunities and invest in innovative initiatives.

Lower Capital Intensity in Digital Companies

Digital companies typically have lower capital intensity than their traditional counterparts, as they do not require as much capital to operate. For example, a mobile app can be distributed for free, while a physical product, like a car, cannot. This lower capital intensity gives digital companies more operating leverage and makes them less vulnerable to economic slowdowns, as they do not have to worry about paying off large debts used to finance inventory that isn’t selling.

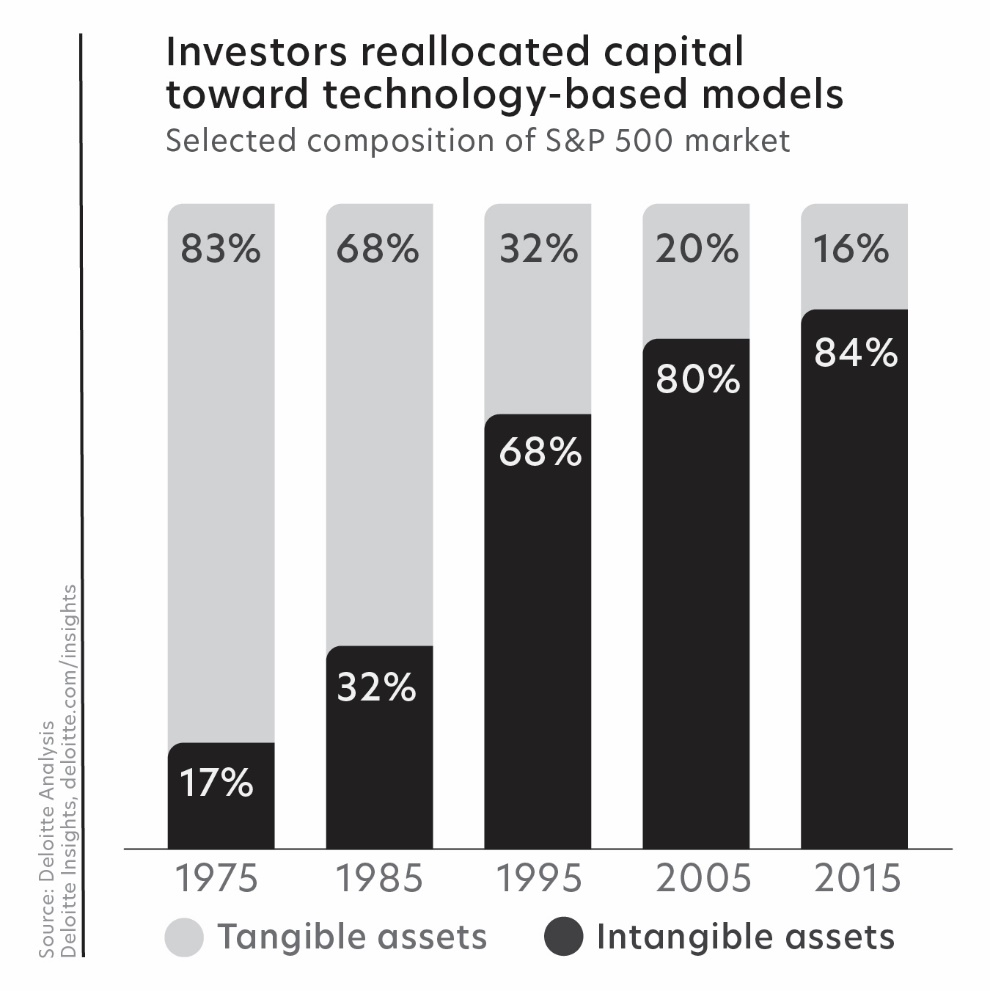

The Shift in the S&P 500

The number of high-valued firms in the S&P 500 relying on capital-intensive assets has been significantly dropping in favor of digital technology-based models. This trend demonstrates the increasing importance of embracing digital transformation and reducing capital intensity to remain competitive in the market.

The Internet of Things and New Opportunities:

The introduction of the Internet of Things (IoT) presents new opportunities and challenges for both digital and traditional companies. Start-ups looking to deploy smart, connected devices may incur additional capital costs they are not used to. Most venture capitalists currently urge their digital portfolio companies to avoid IoT initiatives until they achieve scale or to separate these initiatives into new legal entities to avoid financing connected devices’ debt.

This situation creates a short-term opportunity for legacy companies that already have the balance sheets to support IoT investments and inventory. By embracing IoT technologies, these companies can outmaneuver disruptors while the venture capital community debates the best approach for start-ups.

[i] Authors’ research on www.sec.gov of % growth and % R&D expenditures for companies listed for fiscal years ending in 2019.

[ii] “Investors reallocated capital toward technology-based models,” Deloitte Insights, www.deloitte.com/insights.