Digital Produces Stronger Financials at Scale

Leveraging Digital Technologies for Reduced Distribution Costs and Enhanced Profitability

The digital age has brought about a unique advantage for businesses. Digital products and services have nominal distribution costs and low marginal costs, creating higher gross margins, as companies are able to reduce operational expenses while boosting productivity. In this blog post, we will explore the benefits of digital technology for traditional companies with heavy manufacturing costs and how they can unlock new revenue streams.

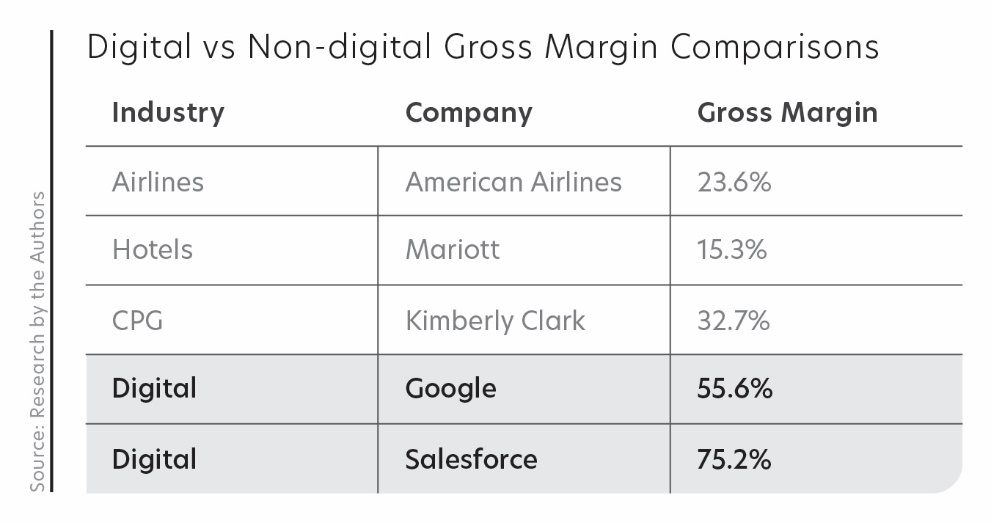

Digitally Transformed Companies Have Higher Gross Margins

Digital companies are known to have higher gross margins at scale when compared to traditional companies. At the time of our research, Google had a gross margin of 55%, while Salesforce had a gross margin of 75%. In contrast, American Airlines and Marriott had gross margins of 23% and 15%, respectively.

Digitally Transformed Companies Have Lower Distribution Costs

Digital companies are able to minimize distribution costs because it costs almost nothing to send 1s and 0s over the internet. It has the added benefit of each new customer deployment having a low marginal cost. Traditional companies, on the other hand, have to deal with high fixed expenses like maintaining manufacturing plants, warehouses, and contracts with distributors. The great the percentage of revenue coming from digital sources will incrementally improve the organization’s profits over time.

Digitized By-products

Successful implementation of digital strategies can help businesses generate more revenue from their digitized by-products. These by-products are typically data-driven digital experiences that can create more revenue and deliver more value at a lower cost compared to core products.

Time to Incubate

Many people misunderstand the economics of startups, as they often look at net income to determine a business’s success. However, this approach is flawed, especially for startups that have not yet achieved scale. In the early stages of development, it is essential to focus on gross margins and ensure that the business can generate revenue at a rate that exceeds its costs. With high gross margins, startups can achieve long-term profitability, even if they are not yet profitable on a net income basis. This is because high gross margins provide a cushion for the company to invest in growth activities, such as market research and development, which can ultimately drive profitability in the long run. Therefore, startups need to focus on achieving high gross margins first before worrying about net income.

Improve Financials or Start Over

A successful digital transformation strategy must go beyond just implementing new technologies and tools, and must also fundamentally change the financials of the business. Simply embarking on a cloud project does not qualify as a digital transformation. Any initiative that only addresses technology without addressing the broader financial picture is likely to fall short of expectations and should be revisited. In fact, every digital transformation must be able to explain how it produces:

- Higher gross margins

- Decreased distribution costs

- Higher research and development spending

- Higher investment in sales and marketing

- Lower capital intensity

Digital technologies offer a pathway to reduced distribution costs and increased profitability for companies across various sectors. By incorporating digital strategies and capitalizing on digitized by-products, businesses can unlock new revenue opportunities and remain competitive in an ever-evolving digital landscape.

[i] Authors’ research on www.sec.gov of gross margin % for companies listed for fiscal years ending in 2019.